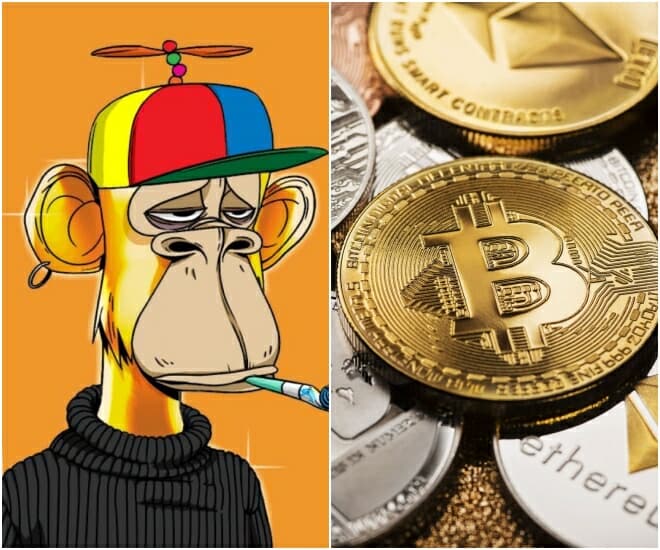

Without a doubt, the past two years have been a rewarding period for those who have ventured into the Nonfungible tokens (NFTs) space. Trading in this new asset reached a peak of US$40 billion last year and its 2022 figures so far have already broken that record at more than US$42 billion, according to crypto research firm Chainanalysis.

For those unsure of this nascent asset class, NFTs are tradable digital assets coded on the blockchain, Ethereum, and can take up forms such as works of art, videos or images. The term made its way into mainstream consciousness last year and has since caught the attention of seasoned and casual investors.

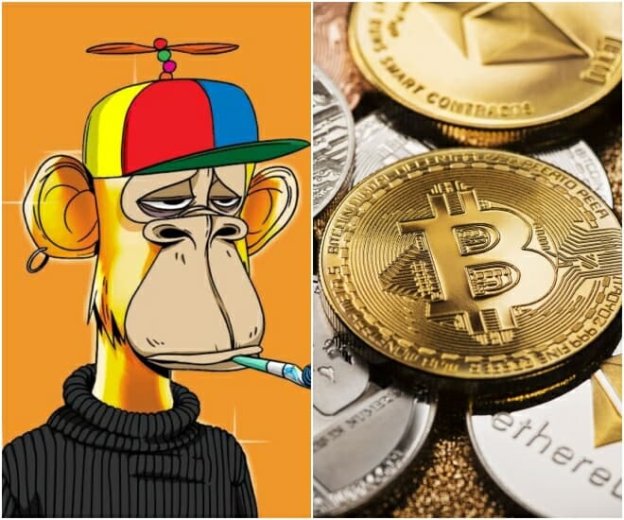

One of the most talked about sales was a collage by digital artist Beeple, which had been sold for a record US$69 million at a Christie’s auction. Other notable transactions include collections from Bored Ape Yacht Club (BAYC) and CryptoPunks, both lured massive followings from celebrities and KOLs.

Despite gaining clout through media representation and endorsements, NFTs and the broader cryptocurrency have come under pressure amid volatility in the wider stock markets where sentiments are bearish. Rising inflation and higher interest rates have dampened the appetite for riskier investments such as tech stocks and digital assets. The recent collapse of TerraUSD and Luna, both stablecoins that are pegged to the US dollar, sparked off greater scepticism about the nature of crypto assets. Additionally, the liquidation of hedge fund Three Arrows Captial spawns further cynicism in the crypto world.

“Crypto winter,” is perhaps the most common phrase when chatting with crypto investors. Overall, the cryptocurrencies’ values have plummeted and erased about US$2 trillion from the market as per a report by CNBC. Bitcoin, the world’s leading digital currency saw its value drop by about 70 per cent since reaching its all-time high in November 2021 at US$69,000. Also going in tandem with the general downward trend are NFTs and Bloomberg reported that sales have plunged this June to below the US$1 billion mark. OpenSea, the largest NFT marketplace saw sales volume fall by 75 per cent since May and this underperformance prompted the company to slash 20 per cent of its job in a bid to reduce costs.

Facing multiple headwinds, many are questioning whether the NFT market will be able to recover from this ordeal. In business terms, it is said the market is undergoing a consolidation period to correct the “errors” that were created. Of the many pressing problems, oversupply appears to be the most pertinent that needs to be addressed. This crash could perhaps have a silver lining because the inherent corrective measures filter out NFT projects that do not possess utility and potentiality.

The days of merely investing in NFTs for its aesthetic appeal are gone. Investors today are more discerning with what is considered a sound investment and a trend that has emerged from this is a newfound emphasis on utility. A tangible outcome has to be offered along with the purchase of an NFT, this is to complete the link between the physical and virtual. If one were to look at the performance of blue-chip projects like Bored Ape Yacht Club (BAYC), the key differentiating factor is community building.

Besides just buying an NFT, investors get to join an exclusive circle that boasts celebrities like Eminem, Paris Hilton and Jimmy Fallon as members and the token acts as a membership card that confers members-only benefits. And these extra “goodies” are what makes it desirable. For example, NFT holders have full commercialisation rights to their Bored Apes, which means you can use the tokens to be part of a product launch.

Apart from fixing a utility aspect to the NFTs, it is also good to explore these tokens’ potential in the future. As the market is still maturing, new research are being made to realise the full benefits of these tokens. In a traditional stock market, investors not only look at the usefulness of the companies against the backdrop of the current demand; astute investors are hedging their money on the future of these companies in an attempt to gain a first mover advantage.

For example, during the nascent days of Web 2.0, companies like Meta (then Facebook), Google and Twitter had undergone the same phrase as what the NFT markets are facing now. These tech stocks were compared against established players like JPMorgan Chase, Goldman Sachs, P&G, Ford, GM and others. But in current times, the former are dominating and are at the forefront and desired by many. This runs parallel with NFTs, and if confidence remains buoyant, the market should be able to tide through these choppy waters and enjoy smooth sailing thereon.

It is true that the NFT market is undergoing one of its darkest periods since its inception, but this also presents an opportunity for creators to relearn what these tokens can do and implement these lessons to safeguard against potential pitfalls again. On a broader note, the situation with cryptocurrencies is part of a business cycle and if investors can ride out this turbulent period, better days will hopefully be around the corner.

For more reads on the Business of Luxury, click here.