Disruptions to supply caused by the pandemic have exacerbated an existing production issue, which was previously dominated by spurious complaints about brands artificially limiting production. We say spurious here because brands do intentionally limit supply, oftentimes based on their ability to do the kind of watchmaking they want, and to manage quality. Rolex, to use the example of the largest maker of watches above CHF3,000, takes about a year to make one watch, start to finish. This is according to independent estimates from a variety of trade publications, forums, Quora and Watchfinder.com. In any case, this illustration can be scaled down to work with brands that make significantly fewer watches. Keep it in mind when you consider the production information from the brands.

Take the example of A. Lange & Söhne, whose Odysseus model is one of the most sought-after in the luxury sports watch category; it sold for almost three times its retail price at a Phillips auction in New York in 2020. The brand continues to emphasise that it produces approximately 5,000 watches annually, and does not intend to go far beyond that. This is despite the fact that the Odysseus model only debuted at the tail-end of 2019.

The Glashutte firm has been saying something like this for more than five years, and possibly as long as 10 years. Fellow Richemont brand Piaget has likewise been saying its production levels for watches remain at 20,000 pieces annually since 2008. These kinds of numbers might seem like smokescreens, but we should always remember that contemporary watchmakers prefer to keep their production at optimal levels, rather than going for maximum results. This combines with the fact all brands — including Rolex — sometimes release clunkers or just models that will eventually be retired. When entire collections such as the Audemars Piguet Millenary are retired (at least in a typical gent’s style), the resulting capacity is simply assigned to other collections.

Speaking of retired collections or models, these are the truly rare watches out there. These will hardly ever be present in large numbers on social media, reselling platforms or brick and mortar stores. After all, whatever is discontinued cannot be found in stores brand new, except for whatever stock remains unsold, and brands will probably act to buy those back to protect their brand value. We have mentioned this earlier and will illustrate the point further with some official statements and quotes. In advance of that, we will take a stand here and suggest that if scarcity is the marker you trust best to establish value, then whatever models you do not see for sale are truly scarce. That makes sense from the perspective of Rolex stores without anything to buy… Or is this just a sign that some watches are so popular that watchmakers are having a tough time meeting demand? Indeed, we think that excited watch buyers are confusing popularity for scarcity.

- READ MORE: Zenith Defy Skyline: Refined Angularity

All this is well and good, and represents a cursory examination with some random evidence that might appear to be tailored to fit our argument. For the avoidance of doubt, this segment includes all public information and statements from the brands on current market conditions. We begin with the most famous of all official words, from the unlikeliest sources: Rolex.

“The scarcity of our products is not a strategy on our part. Our current production cannot meet the existing demand in an exhaustive way, at least not without reducing the quality of our watches — something we refuse to do as the quality of our products must never be compromised. This level of excellence requires time, and as we have always done, we will continue to take the necessary time to ensure that all our watches not only comply with our standards of excellence, but also meet the expectations of our customers in terms of quality, reliability and robustness. Rolex does not compromise on what it takes to produce exceptional watches.”

“All Rolex watches are developed and produced in-house at our four sites in Switzerland. They are assembled by hand, with extreme care, to meet the brand’s unique and high-quality standards of quality, performance and aesthetics. Understandably, this naturally restricts our production capacities — which we continue to increase as much as possible and always according to our quality criteria.”

“Finally, it should be noted that Rolex watches are available exclusively from official retailers, who independently manage the allocation of watches to customers.”

That was the official Rolex line to Yahoo Finance, and it was picked up by every watch specialist, from Hodinkee to WatchPro, with some additional silliness that seemed to be just for the fun of getting the Geneva firm to open up. The above statement though does a bang-up of telling us all what we already know, albeit in words that we can rely on as canon. Patek Philippe, Audemars Piguet and Swatch Group brands can all say different versions of the same thing (minus the bit about the retailers, because Rolex is the only one to rely exclusives on authorised dealers, without brand-run boutiques).

Next up was Patek Philippe President Thierry Stern, who gave a number of important interviews in 2020 and last year, mainly on the subjects of scarcity, production at the manufacture and, of course, the Patek Philippe Ref. 5711/1A.

On the new manufacture building and production: “Today, the building is too big for us but tomorrow, we will need it. My children, if they want to develop the company, they will need it… If we talk about quantity, maybe we will increase by 1-2 per cent (over the course of years) so we need the space for that too. Even with our current production, we have to expect all these watches to return to us for servicing, so that’s another reason I decided on this type of expansion.”

The above is a quote from an interview we published in issue #59. Patek Philippe makes roughly 60,000 watches annually, and the firm will not be running at full capacity in the new building in the immediate future. Even without the pandemic in the mix, the idea is to scale production up gradually. Sustainably even.

On discontinuing Ref. 5711/1A-010 (as told to the New York Times in February last year): “We are doing this for our clients who already own a Patek Philippe and to protect our brand from becoming too commercial. I can continue to make this fantastic product, or sell 10 times more of them. But I am not working for numbers. I am protecting the company for the future, for my children.”

“This is an opportunity to teach a lesson to my kids, who are the first ones to say, ‘Dad, are you crazy?’ They have to learn, just as my father taught me: When you have a fantastic brand like Patek, you have to protect the brand and not just one product.”

And finally, the statement Patek Philippe itself released confirming the end for Ref. 5711/1A-010, edited here for relevance: “We seize this opportunity to reiterate that the priority for Patek Philippe is not to generate short-term profit, but to focus on creating a variety of new models that provide exceptional quality while preserving the value of our customers’ existing timepieces…we will maintain a balance in our collections without focusing on one specific product.” We published this statement in full in issue #60.

- READ MORE: Patek Philippe Ref. 5470P: Extra Time

As that New York Times article mentioned, besides Rolex and Patek Philippe, Audemars Piguet also has one model in particular (non-vintage) that remains a “wrist-power,” object. This is of course the Royal Oak reference 15202ST, which was also recently discontinued and replaced with reference 16202ST, itself a limited proposition for the 50th anniversary of the watch this year. There will only be 1,000 models of reference 16202ST with the 50th anniversary rotor on the brand new calibre 7121, just like the Series A run of the Royal Oak in 1972. Of course, a production run of 1,000 models in 1972 is quite different to that same number today, but Audemars Piguet has to protect the value of all existing watches in its stable, as well as all vintage propositions as well. CEO Francois Henry Benahmias said as much when introducing the entire new range of Audemars Piguet watches this year.

In response to our challenge to the idea of protecting desirability when it feeds the rapacious flipper mentality, the jocular CEO said the following: “We live in a free world…it is a free market. Who are we to determine what people do with our watches? If someone buys a watch from us and wants to sell it, who are we to stop him? Having said that, if someone buys a Royal Oak from us, sells it on, and comes back to try and buy the same watch from us again the week after, maybe we have a different point of view…”

We take Benahmias’ words to mean that collectors cannot be prevented from buying and selling whatever they want, which is only logical and reasonable. The secondary market (pre-owned and grey market) is estimated to be at least an order of magnitude larger than the primary market (EuropaStar, circa 2020) so shutting it down is certainly impractical. On the other hand, opportunists who see quick profits in iconic wristwatches should be resisted, if for no other reason than self-preservation.

- READ MORE: The Timeless Appeal Of Steel Watches

Benahmias and Friedman went on to explain that if Audemars Piguet wanted to make more Royal Oak watches, the firm would have to make less of something else. Other manufactures have made the same point, as we have referenced earlier, and combined with long term growth strategies, all this means that we cannot just have more supply of one or two kinds of watches. Patek Philippe would have to allocate more than 30 per cent of its resources to make more steel watches, and Stern has repeatedly said he does not favour this. It seems logical that Rolex, to use a much larger production business as a counterpoint, would likewise not be interested in growing the volume of its business in steel watches, if it had to do so at the expense of its precious metal watchmaking.

Perhaps if the business in precious metals grows at the same pace, we may yet see more steel watches too, however unlikely it may be that two very different segments would experience the same scale of growth. For the moment, the desire for more of today’s popular models will have to come from the secondary market. This is of course the reason certain older models gain in value over time, when they might have lost a good chunk of the retail value to begin with.

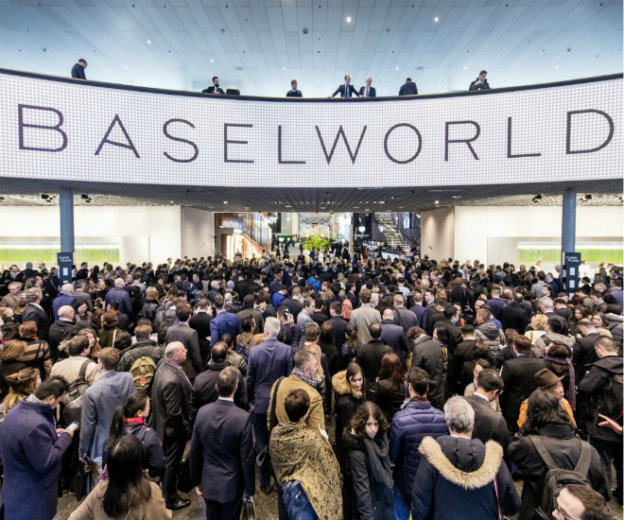

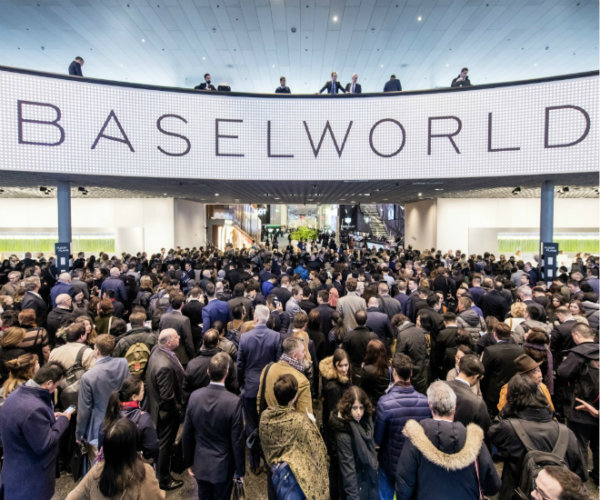

To properly conclude here, there are plenty of brands creating similar watches today, chasing the insatiable desire for symbolic statement watches, such as the Royal Oak and the Nautilus, and dive watches. We have already seen the Parmigiani Tonda PF on one end, and the Tissot PRX on the other. This year so far, the Zenith Defy Skyline is making a play for the same wrist-space. No doubt Watches & Wonders will show us even more dive watches at a variety of price points, and plenty of luxury steel sports watches.

And we have not even discussed the heavily-marketed Bvlgari Octo Finissimo and its part here. Head over to the most popular reselling platforms and see how many of the existing watches we have mentioned in this article (minus the most obvious ones) are available, and at what price. If numbers are really your thing, you will see that scarcity does not always equal eye-watering price tags.

For more watches reads, click here.