Fine watchmaking has plenty of complicated and difficult to understand concepts. By far the toughest to explain is the enduring appeal and value of watches in steel, with some examples commanding the highest value in all of watchmaking. Even worse are the core collection watches that achieve eye-watering prices by being cased in humble steel. This is the reason steel is sometimes called unobtainium in watchmaking circles, being that it is potentially more elusive than even the same watch in platinum.

Part of the reason for the apparently timeless appeal of steel can be found in the key watches of the 1970s, namely the Audemars Piguet Royal Oak and the Patek Philippe Nautilus. To this, one might very reasonably add the Vacheron Constantin Overseas, the Royal Oak Offshore, the Aquanaut and the Girard-Perregaux Laureato, amongst others, as well as the entire catalogue of all non-precious metal Richard Mille watches. These types of watches are classed together in the luxury sports watch category, and Richard Mille in particular has legitimised extraordinary price points for ultra-lightweight watches.

In a totally different vein, Grand Seiko brought fine finishing to the sports watch category, and has thus given tangible form to what prestige sports watches could look like. Not for nothing, Grand Seiko has also brought timekeeping innovation to the table, with Spring Drive being the most exciting chronometric achievement (in series production no less) in the last 20 years. Such exercises in chronometric excellence, combine with Richard Mille’s excessively engineered options, to cite just the entire automatic winding system, to provide a showcase of what fine watchmaking can bring to the table, in terms of robustness.

Richard Mille, Hublot, Roger Dubuis, Panerai and Audemars Piguet have also taken luxury watchmaking into never-before-explored realms of high-tech material science. The amazing growth in value — even at the level of detail — of these sorts of watches represents a triumph of marketing. Not necessarily the sort of marketing that creates desire, but the sort that emphasises the real need for these innovative moves.

This is not to say that the non-precious metal watches are a gimmick — Rolex has yet to endorse even titanium but that probably has more to do with its internal logic than any distaste or distrust of contemporary alloys and composites. The proof for this lies, chiefly, in the presence of ceramic, titanium and bronze cases in the Tudor assortment. Watch collectors have been eagerly awaiting the introduction of titanium cases in the Rolex range, and that would indeed have a transformative effect on the overall watch trade. The key to this lies in which price segment such watches would find themselves.

Currently, watches cased in titanium are typically more expensive than steel, and Rolex would likely only use titanium if it could get the same sort of high sheen that stainless steel can deliver. Such innovation in finishing (or in material science) would require a higher price point, thus playing into the hands of the so-called premiumisation forces currently dominating the market.

Here, the example of Audemars Piguet is most useful because CEO Francois Henry Benahmias has demonstrated the effectiveness of banking on selling fewer watches at ever higher price points. By relentlessly applying this strategy, Audemars Piguet has raised its revenues to within striking distance of Patek Philippe, while producing fewer watches. Intriguingly, Audemars Piguet, unlike Patek Philippe and Rolex, is firmly on the titanium path, and has actually made a Royal Oak reference in titanium, but that was for Only Watch. Nevertheless, Audemars Piguet could have changed things up in the Royal Oak game by introducing titanium for the standard 16202 model, but it opted not to. It could also do the same with ceramic, as it already has in complication territory, while also charging a premium price because of the difficulty in achieving the desired finishing.

Given how the Audemars Piguet numbers look, it is only natural that rivals are keenly studying the situation with regards to premiumisation. The playbook would be simple — establish a popular steel model, and then instead of increasing production of that model, introduce precious metal variants, and focus on selling ever greater numbers of those. There will be questions about where the best margins lie, but this may vary from brand to brand. Tissot illustrates an accelerated version of the premiumisation story with its insanely popular PRX model. It began with a quartz model, followed up with an automatic, and now has a steel and gold version. We have no doubt that all versions of the PRX are successful to some degree, because the aforementioned playbook works like a charm.

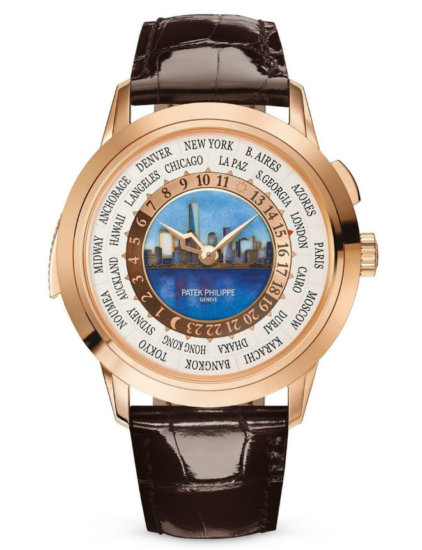

Watchfinder and other specialists are saying that gold is the next go-to material, and perhaps Patek Philippe will endorse this with exclusively gold versions of the Nautilus, as it did with Ref. 3711. It certainly feels logical to shift the collecting conversation away from steel, at least for awhile. Gold changes the value proposition considerably, and raises the asking price at retail accordingly. This becomes more important, and ever more pressing, as prices on the secondary market for steel watches approach those of the gold versions — they already exceed them in some cases.

To close this segment on materials off, we return to Rolex. The brand is doing a masterclass in convincing people to move up the value chain, so to speak, and get precious metal models if steel is simply out of reach. Consider the example of the Rolex Cellini, which is never spoken of as a must-have model, and also that of the Datejust, for broader context. In the first case, you will be hard-pressed to even find a Cellini watch to try on, much less to buy immediately. Here too, you will have to register your interest and wait.

In the second case, we can report that you can still see and try on Datejust models, but you will also be unable to buy any immediately. The Cellini is only available in gold, and a significant proportion of the Datejust range is also only available in precious metals. Clearly, demand for Rolex watches is going far beyond the professional steel sports watch category, but let us look at what a typical watch buying journey might look like for just this one brand.

You would begin, like as not, with the Oyster Perpetual — it might be your first serious watch. After a few years, you might decide that something more substantial might be called for, and now you look to the Oyster Perpetual Submariner with date. From here, you might also consider a Rolesor version of the same, or perhaps even the full gold model. If your wrist could handle it, you might even opt for the Sea-Dweller. From there, you could go in a lot of directions, but you will now have charted a rather specific course in watch collecting.

So, the progression here would be from a simple time-only collection, exclusively in steel, to another collection that also offers gold and half gold options. Well, we say that this is typical but you will find it very difficult indeed to execute this course at this time. It might be that you will have to go straight for that Rolesor Submariner… Once again, if there is any watch you want from Rolex, and fortune favours you, do not hesitate.

For more watch reads, click here.